Conversational AI in banking is changing the financial industry through increased operational efficiency. From offering instant customer service to the customization of financial services, this technology is changing the way that banks are able to reach their customers.

With AI-driven insights and automation, banks can deliver faster, more accurate, and seamless experiences, ultimately boosting customer satisfaction and loyalty. Let’s learn more about its effects, advantages, and applications of the concept in this informative blog.

What is Conversational AI in Banking?

Conversational AI in banking, or CIB, is all about using smart chatbots and virtual assistants to make it easier for banks to connect with their customers. With the help of technologies like natural language processing (NLP) and machine learning (ML), these AI tools can understand what customers are saying and respond in a way that makes sense—just like a helpful assistant would.

It enables banks to offer unique experiences, enhance the performance of their operations, and address the growing needs of the digital generation. It is also applicable in different points of contact, including mobile applications, websites, and messaging apps to ensure that the customer is presented with one clear picture.

Pro-tip

Banks can leverage GPT-based conversational AI to upsell financial products. For example, if a customer frequently inquires about investment options, AI technology can suggest tailored mutual fund plans, making the interaction both helpful and profitable.

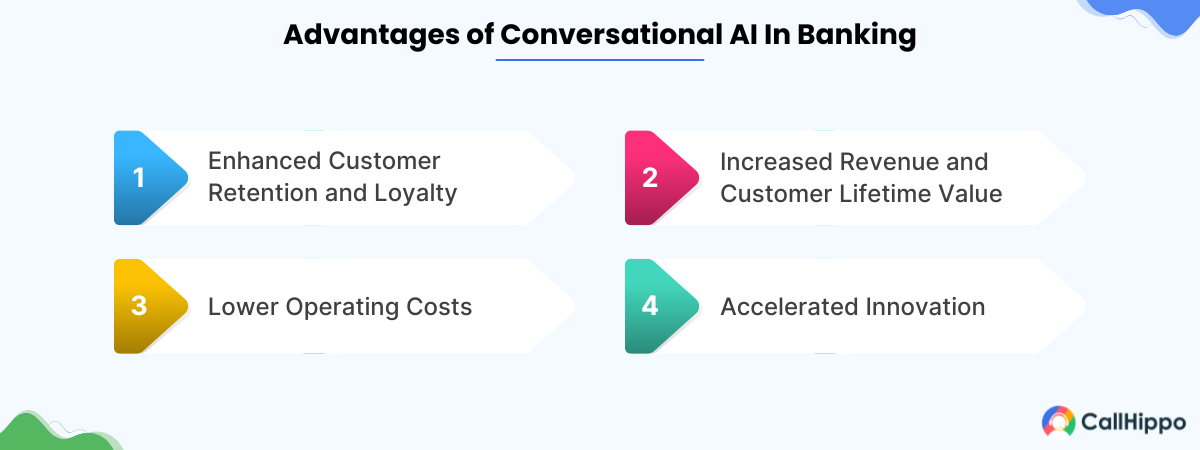

Benefits of Conversational AI for Banking

Conversational AI brings numerous advantages to the banking sector, revolutionizing how financial institutions operate and interact with customers. Below are the key benefits explained in detail.

1. Enhanced Customer Retention and Loyalty

Conversational AI strengthens customer relationships by offering timely, personalized support. Virtual assistants streamline tasks like account management and transaction tracking, addressing concerns instantly. These proactive engagements build trust, ensuring long-term loyalty and satisfaction.

2. Increased Revenue and Customer Lifetime Value (CLV)

Analyzing customer behavior, conversational AI identifies opportunities for cross-selling and upselling. After recommending relevant products at optimal times, banks increase revenue. Continuous, meaningful interactions also elevate overall customer lifetime value.

3. Lower Operating Costs

Automating repetitive customer inquiries minimizes the reliance on large support teams. AI tools efficiently manage high volumes of queries, significantly reducing operational costs without compromising service quality.

4. Accelerated Innovation

A conversational AI platform empower banks to stay competitive by adapting swiftly to market trends. By integrating AI, banks can introduce new, customer-centric features that address evolving financial needs and expectations.

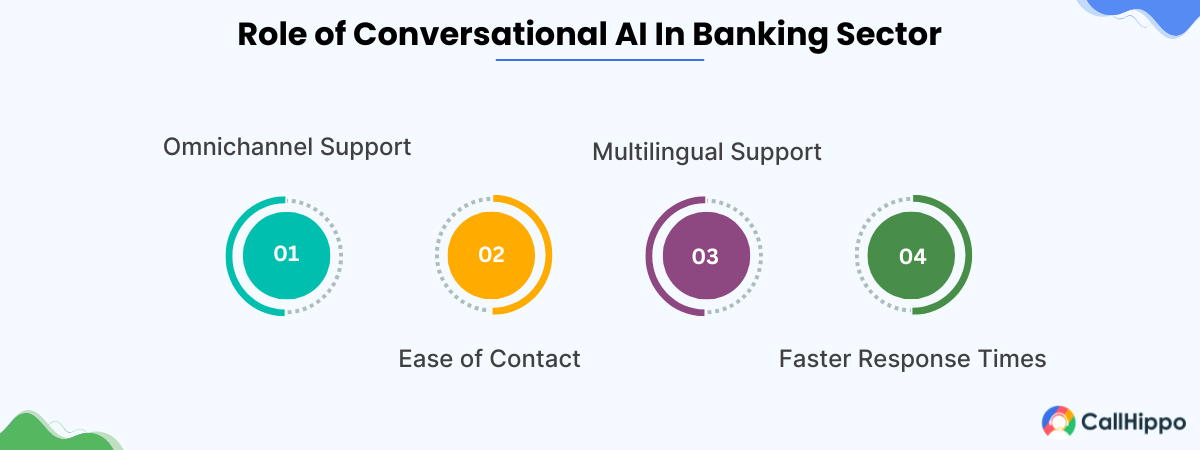

The Role of Conversational AI in Banking

Conversational AI plays a crucial role in modernizing banking services by enabling streamlined communication and operational efficiency. Below are the core aspects of its role in banking.

1. Omnichannel Support

Conversational AI ensures customers can access support through various channels, such as mobile apps, websites, and social media platforms. This omnichannel approach creates a unified and consistent experience.

2. Ease of Contact

With conversational AI, customers no longer need to navigate complex IVR systems. Virtual assistants offer direct and user-friendly interactions, making it easier to get assistance.

3. Multilingual Support

AI-powered tools can communicate in multiple languages, enabling banks to cater to diverse customer bases across geographies. This feature improves accessibility and customer satisfaction.

4. Faster Response Times

Unlike traditional methods, conversational AI can instantly address queries and resolve issues. This speed significantly enhances customer experience by minimizing wait times.

Enhance Your Banking Services

With AI Sales Agent

- 24/7 Personalized Customer Support

- Instant Loan Assistance

- Fraud Prevention & Enhanced Security

Conversational AI Use Cases in Banking

Conversational AI’s versatility enables various use cases in banking, improving customer service and operational efficiency. Here are the top applications:

https://webcdn.callhippo.com/blog/wp-content/uploads/2025/01/conversational-ai-use-case-in-banking.png

1. Personalized Banking Services

AI-driven chatbots play a pivotal role in transforming traditional banking by offering highly personalized services. By analyzing vast amounts of customer data, such as spending patterns, account activity, and financial goals, these intelligent systems provide tailored financial advice and product recommendations.

2. Loan Assistance and Claim Filing

Conversational AI simplifies complex processes like filing insurance claims and applying for loans. Virtual assistants guide users step-by-step, reducing errors and improving turnaround times. By automating document verification and ensuring compliance with requirements, AI reduces the administrative burden on both customers and banks.

3. Automated Customer Service

AI-powered customer service tools efficiently handle routine inquiries such as account balance checks, transaction tracking, and card activations. These systems operate 24/7, providing customers with instant responses and reducing wait times. By automating repetitive tasks, businesses can significantly improve operational efficiency.

4. Fraud Prevention

AI-driven fraud detection systems continuously monitor transactions, analyzing patterns to identify and flag suspicious activities in real time. These advanced systems can detect anomalies that traditional methods might miss, providing instant alerts to both financial institutions and customers.

AI-based fraud prevention systems are 25% more accurate compared to traditional systems.

-accenture.com

5. Member Support

Credit unions and community banks can harness the power of conversational AI to deliver personalized and timely support to their members. These AI-powered solutions can handle a wide range of inquiries, from account management and loan information to financial guidance and transaction assistance.

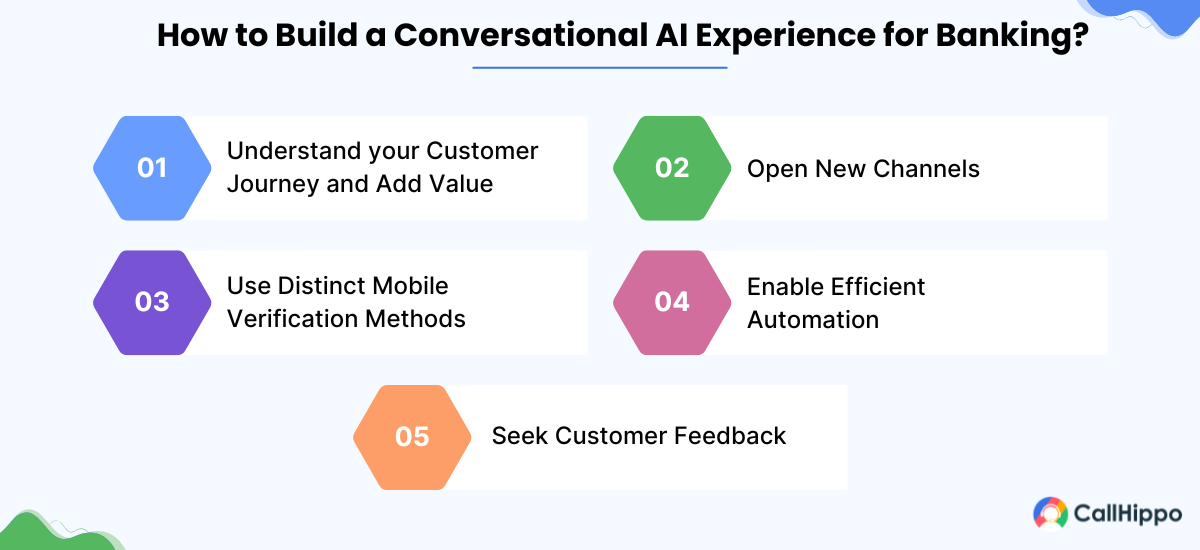

How to Develop a Conversational AI Banking Experience?

Creating an effective conversational AI experience involves a strategic approach. Below are the essential steps to consider:

1. Understand your Customer Journey and Add Value

Start by studying how customers interact with your bank and identify areas where they face challenges or delays. Use this understanding to design solutions that make their experience easier and more enjoyable. Focus on creating systems that effectively address customer needs, whether faster query resolutions or tailored advice.

By making their journey smoother, you not only enhance satisfaction but also build lasting trust and loyalty. This approach ensures that your efforts align with what truly matters to your customers.

2. Open New Channels to Increase Customer Touchpoints

Make banking services available through multiple platforms like messaging apps, social media, or voice assistants. This ensures customers can connect with your services wherever they feel most comfortable.

Whether it’s checking balances via WhatsApp or using voice commands on smart devices, offering more channels improves convenience. Consistency across these touchpoints is key to creating a unified experience. By being accessible across platforms, you increase engagement and make it easier for customers to stay connected with their finances.

3. Use Distinct Mobile Verification Methods

Security in banking is crucial, and using reliable mobile verification methods is essential. Features like fingerprint or facial recognition, one-time passwords, or multi-step authentication keep customer data safe while making access easy.

For example, biometrics ensure quick and secure logins without needing to remember passwords. These measures reassure customers that their accounts are protected while providing a smooth and hassle-free experience. Regularly updating these verification methods helps stay ahead of security threats and ensures ongoing customer confidence.

4. Enable Efficient Automation

Simplify routine tasks like checking balances, transferring funds, or paying bills by automating them. This not only saves time for customers but also reduces pressure on customer service teams. Automated systems can provide quick answers to common questions, ensuring customers don’t have to wait for assistance.

With these tasks handled efficiently, staff can focus on helping with more complex issues. Automation also makes it easier to manage high volumes of requests during busy times, improving overall service quality and response speed.

5. Seek Customer Feedback

Regularly ask for customer feedback to understand what works and what doesn’t. Whether through surveys, reviews, or direct conversations, this input is vital for making improvements. Use the insights to fix problems, refine services, and ensure your systems meet customer expectations.

By showing that you value their opinions, you strengthen relationships and demonstrate a commitment to continuous improvement. Listening to customers and acting on their suggestions ensures you stay relevant and provide a service they trust and rely on.

Conversational AI in Banking: Key Benefits and Challenges

Conversational AI is reshaping the banking industry, providing personalized experiences and operational efficiency. However, adopting this technology comes with unique challenges that must be addressed for successful integration. Below, we explore the key benefits and challenges associated with conversational AI in banking.

Key Benefits of Conversational AI in Banking

Let’s check out the main advantages of conversational AI in the banking sector –

1. Individualized Financial Advice

Conversational AI leverages data analytics to offer personalized financial advice based on a user’s behavior, preferences, and financial history. By analyzing spending patterns, investment goals, and risk tolerance, AI-powered assistants can recommend tailored solutions such as saving plans or loan options.

This enhances the customer experience and empowers users to make informed decisions. Unlike traditional services, conversational AI provides instant, data-driven advice, eliminating the need to wait for human assistance. This level of personalization fosters trust and strengthens relationships, making customers feel valued and understood.

2. Uninterrupted Transactional Assistance

AI-powered virtual assistants provide 24/7 transactional support, ensuring seamless banking experiences. Customers can access services like fund transfers, balance inquiries, or bill payments at any time without delays. This uninterrupted availability enhances user convenience and satisfaction.

Additionally, conversational AI reduces the dependency on human support, minimizing operational costs for banks. Virtual assistants can handle multiple queries simultaneously, improving service efficiency during peak times. With continuous advancements, these systems are becoming more intuitive, addressing complex requests with precision. As a result, customers experience quicker resolutions, contributing to a more reliable banking environment.

3. Strong Compliance and Governance

Conversational AI systems are designed to comply with banking regulations and governance policies, reducing compliance risks. These tools can analyze conversations to ensure adherence to industry standards and flag any discrepancies in real time. AI also assists in monitoring transactions for anti-money laundering (AML) compliance or Know Your Customer (KYC) requirements.

After automating these processes, banks achieve higher accuracy and efficiency in meeting regulatory obligations. This proactive approach not only safeguards institutions from penalties but also reinforces customer trust. As regulations evolve, AI solutions adapt, ensuring ongoing compliance in a dynamic banking environment.

Challenges While Implementing Conversational AI in Banking

While there are plenty of benefits, conversational AI comes with its own set of challenges as well.

1. Integration with Legacy Banking Systems

Integrating conversational AI with outdated banking systems remains a significant challenge. Many banks operate on legacy infrastructure that lacks compatibility with advanced AI tools, leading to inefficiencies. Upgrading these systems requires significant time, cost, and resources, often disrupting daily operations.

Additionally, technical mismatches can hinder the seamless functioning of AI-powered solutions, affecting user experience. Banks must adopt strategies to modernize their infrastructure without compromising operational continuity. Cloud-based platforms and APIs offer potential solutions for bridging this gap, enabling smoother integration. However, achieving a balance between innovation and legacy system stability remains a complex task.

2. Ensuring Data Security and Privacy

Data security and privacy are critical concerns in conversational AI for banking. These systems handle sensitive customer information, such as account details and financial transactions, making them attractive targets for cyberattacks. Robust encryption protocols, regular vulnerability assessments, and strict access controls are essential to protect this data.

Banks must also ensure compliance with global privacy regulations like GDPR or CCPA to avoid legal repercussions. Customers’ trust hinges on the assurance that their information remains confidential and secure. As conversational AI continues to evolve, integrating advanced cybersecurity measures will be imperative to mitigate risks and safeguard user data.

3. Managing Bias in AI Systems

Bias in conversational AI systems can lead to unfair or inaccurate outcomes, damaging customer trust and brand reputation. These biases often arise from skewed training data or poorly designed algorithms.

For example, an AI tool may unintentionally favor certain demographic groups over others in loan approvals or financial advice. Identifying and addressing these biases requires constant monitoring, diverse data sets, and ethical programming practices.

Banks must prioritize fairness and transparency in their AI solutions, ensuring equitable treatment for all users. Regular audits and collaborations with unbiased third parties can help mitigate this challenge, fostering inclusivity and accuracy.

Future Trends in Conversational AI for Banking

As conversational AI evolves, several trends are shaping its future in the banking industry:

1. Generative AI for Personalized Interactions

Generative AI models, such as GPT, are transforming how banks engage with customers by delivering tailored, context-aware conversations. These models analyze individual customer data, preferences, and behavior to generate responses that feel human-like and relevant.

This level of personalization not only enhances user satisfaction but also builds stronger customer relationships. From answering complex queries to offering tailored financial advice, generative AI improves engagement while ensuring a seamless experience.

As these models evolve, they promise to redefine how banks interact with their clients, making conversations more intuitive, empathetic, and effective.

2. Enhanced Fraud Detection Capabilities

Conversational AI is taking fraud detection in banking to new heights. By leveraging machine learning and predictive analytics, AI tools monitor customer interactions and transactions in real time to identify unusual patterns or suspicious activities.

These systems can analyze vast datasets faster than humans, detecting potential threats with higher accuracy and reducing false positives. Banks can then proactively alert customers or block fraudulent transactions, ensuring their assets and data remain secure.

This advanced fraud prevention capability strengthens customer trust and minimizes financial losses, making AI an invaluable ally in combating cyber threats.

3. AI-Powered Customer Journey Analytics

AI-powered customer journey analytics enable banks to understand client behavior across multiple touchpoints, optimizing their interactions and offerings. By analyzing data from conversations, transactions, and online behavior, AI tools identify patterns, preferences, and pain points.

Banks can use these insights to create targeted marketing campaigns, enhance customer support, and introduce personalized products or services. This not only improves the customer experience but also boosts loyalty and drives business growth. AI’s ability to predict future customer needs ensures that banks stay ahead in delivering solutions, fostering a more connected and meaningful customer journey.

Conclusion

Conversational AI in banking is no longer a futuristic concept; it’s a necessity for modern financial institutions. By embracing this technology, banks can improve efficiency, enhance customer experiences, and stay competitive in a rapidly evolving landscape.

Furthermore, the ability to harness valuable data insights enables banks to proactively meet customer needs and remain agile in a rapidly evolving financial landscape. Institutions that embrace conversational AI today are better positioned to foster long-term customer loyalty, drive growth, and maintain a competitive edge in the digital age.

FAQs

1. How does conversational AI enhance fraud detection?

AI systems monitor transactions in real time and flag unusual patterns, preventing fraud.

2. What role does conversational AI play in customer onboarding?

AI simplifies onboarding by automating documentation, identity verification, and account setup.

3. Can conversational AI assist with personalized financial planning?

Yes, it analyzes customer data to recommend tailored financial plans and investment strategies.

4. What impact does conversational AI have on customer retention?

By offering personalized and instant support, conversational AI builds trust and fosters long-term relationships.

Let’s Stay in Touch

Subscribe to our newsletter & never miss our latest news and promotions.