Banks have been using AI for a while now—flagging fraud, crunching credit scores, and personalizing offers. But Agentic AI in Financial Services? That’s a whole new game. It doesn’t just follow instructions. It sets its own goals, makes strategic decisions, and adjusts dynamically –like a financial analyst with intuition, speed, and zero downtime.

If traditional AI is your calculator. Agentic AI is your CFO.

In a sector defined by risk, regulation, and razor-thin margins, the emergence of agentic systems marks a turning point. We’re not talking about marginal gains or fancy dashboards. We’re talking about structural change—across asset management, compliance, customer engagement, and credit decisioning.

But here’s a hot take: If you’re still using AI just to automate workflows, you’re already behind. The leaders aren’t just automating—they’re delegating.

So ask yourself—would you trust an AI to make a million-dollar lending decision on your behalf?

Create Frictionless Experiences For Your Financial Service Customers Build Unique, User-Friendly Apps & Digital Payment Solutions

What Is Agentic AI – How Is It Transforming the Financial Service Industry?

Agentic AI refers to artificial intelligence systems capable of autonomous decision-making, goal-setting, and adaptation—without needing constant human supervision. That’s a big deal in financial services—because it means AI isn’t just supporting back-office processes. It’s beginning to run important processes with context-awareness and real-time optimization. All done with exceptional speed.

A report by McKinsey highlights that agentic systems could boost productivity by up to 30%. This is especially in areas like customer onboarding, risk assessment, and portfolio management.

Here’s how it’s already transforming the industry:

- In asset management, agentic AI acts like your sharpest portfolio manager—minus the coffee breaks. No manual hustle. Just smart, automated moves.

- In lending, decisions that used to take hours now take milliseconds. Agentic systems crunch structured and unstructured data—credit history, bank statements, even sentiment—then deliver faster, fairer loan outcomes. It’s speed without bias.

- In compliance, it’s like having a 24/7 watchdog with a law degree. Agentic AI tracks regulation shifts, flags suspicious patterns, and adapts to new policies before your compliance team even hits refresh. No more scrambling when auditors show up.

This isn’t experimental anymore. If your bank still relies on manual decision chains, the real risk might not be in adopting Agentic AI—it’s in ignoring it.

Blog: Agentic Al vs Traditional Al: Understanding The New Era of Technology

What Are the Benefits of Agentic AI in the Financial Sector?

The biggest advantage of Agentic AI in financial services is simple: better decisions, made faster—with less human drag.

Agentic AI doesn’t just process data; it interprets intent, adapts to new signals, and takes initiative. That’s a huge leap in a world where timing and trust are everything.

By 2028, Deloitte says AI could slash software investment costs by 20% to 40%. Do it right, and banks could save up to $1.1 million per engineer.

- Faster decisions, zero drama – Fraud alerts? Loan approvals? Agentic systems handle it in real time. No more batch queues or red tape.

- Personalization on autopilot – These AIs know what customers want before they do. Dynamic offers, tailored nudges, frictionless onboarding—done.

- Compliance that never clocks out – Agentic AI in banking and finance can watch out for regs 24/7. It spots policy shifts and stops breaches before they happen.

- Costs down, speed up – What takes a human hours, agents do in seconds. Now scale that across thousands of tasks. That’s efficiency with a capital E.

- AI with a strategy hat – This isn’t reactive AI. It thinks ahead—optimizing portfolios, forecasting liquidity. Basically, your tireless junior strategist—minus the all-nighters.

Here’s the question: Are your human teams spending hours making decisions that an AI agent could resolve in seconds? Because in finance, slow decisions are expensive decisions.

Top Use Cases

Here are the top five real-world applications of AI-powered financial services driven by agentic systems:

1. Autonomous Portfolio Rebalancing

Robo-advisors powered by agentic AI are now able to make micro-adjustments to portfolios based on market swings, client sentiment, and long-term goals—without waiting for human review. Platforms like Wealthfront use AI to keep investment portfolios in check.

2. Dynamic Fraud Detection

Rather than flagging predefined red flags, agentic AI in banking and finance learns the user’s behavioral fingerprint. It can detect anomalous activity in seconds, even if it’s never seen that pattern before.

3. AI-Driven Credit Underwriting

Traditional scoring models use fixed criteria. Agentic systems blend traditional and alternative data—like transaction history, geolocation, and even tone in customer communication—to build nuanced borrower profiles.

4. Regulatory Change Management

Instead of manually interpreting thousands of pages of new compliance updates, agentic systems ingest and act on them automatically—triggering workflows, updating documentation, and training staff through personalized AI tutors.

5. Personalized AI Agents for HNIs

Some private banks are offering bespoke AI financial agents that act on behalf of high-net-worth individuals—handling alerts, rebalancing portfolios, generating reports, and even booking meetings with human advisors. These agents learn preferences and adjust strategies over time—just like a human relationship manager would.

Discover Customized Fintech Solutions That Can Ramp Up Your Financial Services

Common FAQs

Q: How Agentic AI is transforming financial services?

A: AI doesn’t just predict risks—it anticipates them. It doesn’t just personalize—it preempts. McKinsey says the prize is massive: $1 trillion in annual value for global banking, thanks to sharper decisions, smarter workflows, and leaner operations.

This isn’t an “innovation lab” experiment anymore. It’s core strategy. It’s in underwriting, fraud detection, investment strategies, compliance monitoring—and it’s changing how banks think, operate, and compete.

Q: What are the applications of Agentic AI in banking?

A: Agentic AI powers autonomous decision-making across the banking value chain.

Key use cases include:

- Autonomous customer onboarding

- Real-time fraud prevention

- Portfolio optimization for wealth clients

- Credit decisioning using alternative data

- Dynamic compliance tracking

- Conversational AI agents can think and act

Unlike traditional AI, which waits for input, agentic models initiate actions based on context and intent. It functions more like intelligent teammates than static tools.

Q: Is AI safe to use in financial decision-making?

A: It can be—but only when governed properly. Agentic AI doesn’t just automate — it acts. And with that autonomy comes new responsibilities: traceability, auditability, and fairness. Good intentions mean little if AI decisions are a black box. Use explainable frameworks so every action can be traced and trusted.

Q: How does Agentic AI improve customer experience in finance?

A: By transforming banking into more of a relationship rather than a mere transaction. Agentic AI allows for hyper-personalization: tailored deals, timely notifications, adaptive spending analysis, and immediate support. It can predict customer wants, respond to choices, and even address issues before the customer signals for help. An agentic system could recognize a customer’s international travel and immediately modify fraud detection limits, notify them of foreign exchange fees, or recommend travel insurance—all automatically.

That’s not just smart CX. That’s loyalty, built in.

Q: Could Agentic AI be the key to financial compliance efficiency?

A: Definitely—and it’s in progress.

Agentic AI can analyze new regulations, align them with internal policies, and automatically initiate updates throughout systems. It continuously performs checks, identifies anomalies instantly, and produces audit-ready logs automatically.

Q: What does Agentic AI refer to?

A; Agentic AI denotes AI systems that work with a degree of freedom. They are able to establish objectives, make choices, adjust to new circumstances, and take action without needing human prompts. They don’t adhere to rules—they find solutions.

This concept goes beyond automation. Agentic AI mimics human reasoning and initiative, allowing financial institutions to offload entire decision chains, not just isolated tasks.

Q: What is the role of Agentic AI in banking?

A: The core function? Delegation with confidence.

Agentic AI in finance functions as a battalion of relentless junior analysts. It performs fraud evaluations, optimizes investment tactics, and executes rapid, data-informed choices. No delays. No burnout. Just consistent performance across millions of transactions. It cuts human bottlenecks and keeps things moving—fast and fair.

Q: What are the Agent AI-related dangers and Challenges in Finance?

A: Here’s the honest truth: agentic AI can be brilliant—and also brittle.

Decisions can lack transparency, making it tough to trace logic—bad news for compliance and reputation. If trained on biased data, agents may reinforce unfair practices in lending or fraud checks. They’re also vulnerable to attacks, especially in high-stakes financial environments. And the more we rely on them, the more human oversight can fade—dangerous when edge cases hit.

Best Practices to Begin with AI Agents in Finance

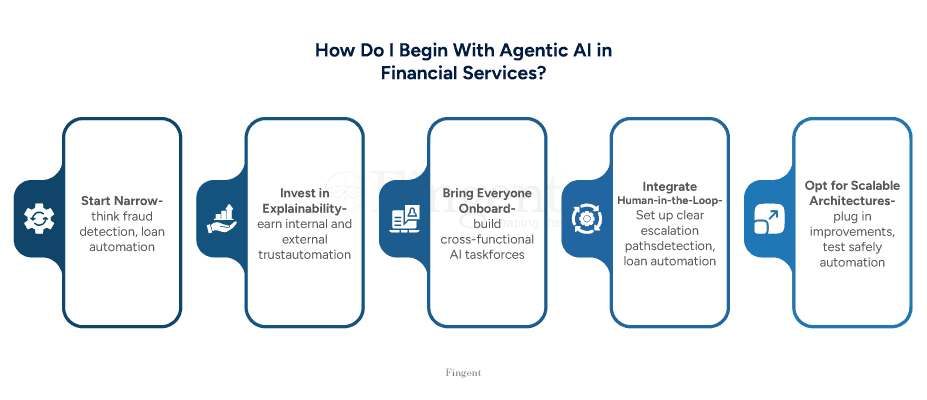

You don’t jump into agentic AI the way you’d test a chatbot. This isn’t just plug-and-play tech—it’s strategic infrastructure. Always keep the goals and strengths of Agentic AI at the forefront and play to these strengths. Think high-impact use cases. Establish cross-functional task forces. Build scalable, modular architectures. This is what will get you the most benefit from Agentic AI.

Here are the best practices that separate smart adopters from expensive mistakes:

1. Start with Narrow, High-Impact Use Cases

Don’t boil the ocean. Begin with agentic pilots where the business case is clear—think fraud detection, loan automation, or KYC. Prove value. Then scale.

2. Invest in Explainability from Day One

Agentic AI must earn internal and external trust. Ensure all decisions are auditable and interpretable. That’s not optional—it’s regulatory survival.

3. Build Cross-Functional AI Taskforces

Bring together data scientists, compliance officers, finance leads, and customer experience heads. Why? Because deploying AI agents is everyone’s job.

4. Integrate Human-in-the-Loop Governance

Give AI agents autonomy. But within smart boundaries. Set up clear escalation paths for when agents hit a wall. Don’t leave them guessing.

5. Opt for Scalable, Modular Architectures

Ensure to pick scalable, modular architectures. That way, you can plug in improvements, test safely, and grow without breaking what already works.

How Can Fingent Help?

Fingent brings more than AI capability—we bring business clarity.

Our approach to agentic AI in financial services is grounded in one principle: strategy before software. We don’t just throw models at problems. We diagnose what matters, design what scales, and deploy what works.

Here’s how we help circumnavigate and win with agentic AI:

- Use Case Identification with Measurable ROI

We work with your stakeholders to pinpoint the highest-leverage agentic opportunities—those that cut costs, boost margins, or elevate experience. Fast. - Custom AI Agent Development

Need an agent that adapts to your risk models? Or one that acts on portfolio thresholds? We design and build autonomous agents that speak your business language—not generic code. - Trust-First Architecture

All our deployments include explainability frameworks, fairness checks, and built-in compliance mapping—so your AI earns internal trust and passes external scrutiny. - Integration with Your Existing Stack

Whether you’re on Salesforce, Temenos, or a custom core system—we integrate cleanly. No forklift upgrades. No system sprawl.

AI Agents are the future. If you are yet to embrace them now for your financial services, then you must act now! Connect with our experts today and explore your opportunities with Agentic AI in financial services.