Launched in 2014, the Make in India initiative has significantly transformed India’s automobile industry, fostering domestic car production and accelerating electric vehicle (EV) manufacturing. Over the past decade, policy reforms, fiscal incentives, and infrastructure development have positioned India as a key global automotive hub. The sector has attracted substantial investments, spurred innovation, and increased localization, contributing to economic growth and sustainability.

The Indian auto industry is one of the fastest-growing sectors. It embarked on a new journey in 1991 with the de-licensing of the sector and subsequent opening up for 100 percent FDI through the ‘automatic route’. Since then, almost all the global majors have set up their manufacturing facilities in India, taking the level of production of vehicles from 2 million in 1991-92 to around 28 million in 2023-24.

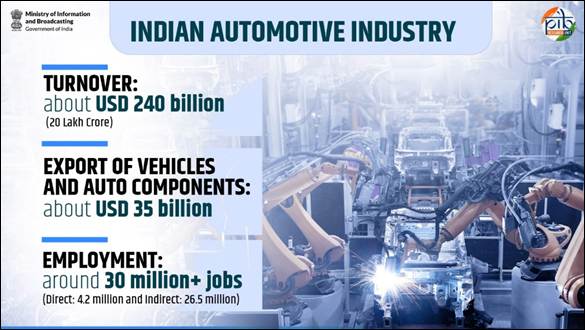

The turnover of the Indian automotive industry is about USD 240 billion (20 Lakh Crore), which translates into a large contribution to the country’s economy and manufacturing sector. As per the Annual Report 2024-25 of the Ministry of Heavy Industries, around 30 million jobs (Direct: 4.2 million and Indirect: 26.5 million) are supported by the Indian Auto Industry. Indian Automotive Industry exported vehicles and auto components amounting to about USD 35 billion. In terms of global standing, India is the largest manufacturer of three-wheelers, among the top 2 manufacturers of two-wheelers in the world, the top 4 manufacturers of passenger vehicles, and the top 5 manufacturers of commercial vehicles in the world.

Auto Components Industry in India

The auto component sector is one of the key pillars of India’s manufacturing industry, supplying critical parts and systems to domestic vehicle manufacturers and exporting to major global markets. The industry covers a broad spectrum of products, including engine parts, transmission systems, braking systems, electrical and electronics components, body and chassis parts, and more. India has become a preferred destination for auto component manufacturing due to its cost competitiveness, skilled workforce, and strong policy support. The auto component sector is expected to reach the $100 billion export target by 2030 making the sector one of the largest job creators in the country.

Overview of the Auto Components Industry

|

Contribution to GDP |

2.3% |

|

Direct Employment |

1.5 million people |

|

Industry Turnover (FY24) |

Rs. 6.14 lakh crore (US$ 74.1 billion) |

|

Domestic OEM Supply Share |

54% |

|

Export Share |

18% |

|

CAGR (FY16-FY24) |

8.63% |

|

Export Value (FY24) |

US$ 21.2 billion |

|

Projected Exports (2026) |

US$ 30 billion |

India’s auto component sector contributes 2.3% to India’s GDP, directly employing over 1.5 million people. The sector’s turnover in FY24 was Rs. 6.14 lakh crore (US$ 74.1 billion), with domestic OEM supplies making up 54%, and exports contributing 18%. Over FY16-FY24, the industry grew at a CAGR of 8.63%. In FY24, exports reached US$ 21.2 billion, with a trade surplus of US$ 300 million, and are projected to hit US$ 30 billion by 2026.

The Indian auto components industry exports over 25% of its production annually. By FY28, the Indian auto industry aims to invest US$ 7 billion to boost the localisation of advanced components like electric motors and automatic transmissions by reducing imports and leveraging the “China Plus One” trend. In 2023, the auto component industry achieved a 5.8% reduction in imports over two years. The majority of the components sold to Original Equipment Manufacturers (OEMs) are engine components (26%), body/chassis/BIW (14%), suspension and braking (15%), drive transmission and steering (13%), and electricals & electronics (11%). Major exports are to Europe (US$ 6.89 billion), followed by North America (US$ 6.19 billion) and Asia (US$ 5.15 billion).

Growth in Domestic Automobile Production

The automobile sector contributes approximately 6% to India’s national GDP, with exports reaching 4.5 million units across all categories in FY 2023-24, including 6.72 million passenger vehicles and 3.45 million 2-wheelers. Global automotive companies like Skoda Auto Volkswagen India exporting 30% of their production and Maruti Suzuki exporting around 2.8 lakh units annually, exemplify this trend.

The sector has attracted $36 billion in Foreign Direct Investment (FDI) over the past four years, highlighting India’s growing prominence in the global automotive landscape. Major international players are making substantial commitments, with Hyundai planning a USD 4 billion (INR 33,200 Crore) expansion, while Mercedes-Benz has pledged USD 360 million (INR 3,000 Crore). Recently, Toyota announced a USD 2.3 billion (INR 20,000 Crore) investment to further increase its capacity.

Electric Vehicle (EV) Manufacturing Boom

The country is also advancing in sustainable mobility, with 4.4 million Electric Vehicles (EV) registered by August 2024, including 9.5 lakh in the first eight months of 2024, achieving a 6.6% market penetration. To support this growth, the government has implemented initiatives such as the Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cell (ACC) battery storage. In the 2024-25 Budget, the government allocated INR 2,671.33 crore under the FAME scheme and proposed the exemption of customs duties from the import of critical minerals required for EV cell components manufacturing.

Additionally, in March 2024, the Electric Mobility Promotion Scheme (EMPS) was launched with an INR 500 Crore outlay for four months, specifically targeting support for the two and three-wheeler segments to expedite the transition to electric vehicles. These initiatives align with the recent discovery of lithium deposits in Jammu & Kashmir, positioning India to become a key player in the global battery manufacturing industry in the coming years. The Indian EV sector is likewise developing quickly and is predicted to record a growth of USD 113.99 billion in 2029.

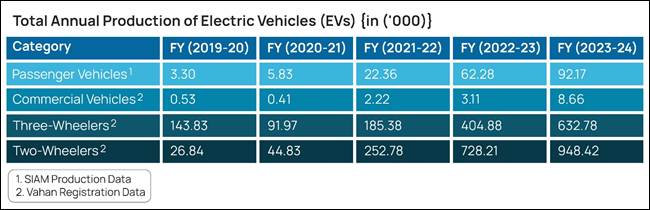

As per the inputs provided by Society of Indian Automobile Manufacturers (SIAM), the total annual production of Electric Vehicles (EVs) in India during the last five years, year-wise is as given below:

The Ministry of Heavy Industries has formulated the following schemes to promote electric vehicles (EVs) and to address the various challenges faced in adoption of electric mobility including availability and accessibility of charging stations in the country:

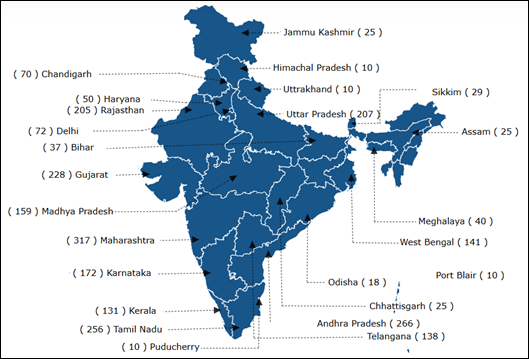

- Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India) Scheme Phase-II: The Government implemented this scheme for a period of five years from 1 April 2019 with a total budgetary support of INR 11,500 Crore. The scheme incentivised e-2Ws, e-3Ws, e-4Ws, e-buses and EV public charging stations. The Department of Heavy Industries has also sanctioned 2636 charging stations in 62 cities across 24 States/UTs under phase II. State-wise allocation of these charging stations is as follows:

- Production Linked Incentive (PLI) Scheme for Automobile and Auto Component Industry in India (PLI-Auto): The Government notified this scheme on 23 September 2021 for Automobile and Auto Component Industry in India for enhancing India’s manufacturing capabilities for Advanced Automotive Technology (AAT) products with a budgetary outlay of INR 25,938 Crore. The scheme proposes financial incentives to boost domestic manufacturing of AAT products with minimum 50% Domestic Value Addition (DVA) and attract investments in the automotive manufacturing value chain.

|

Feature |

Details |

|

Budgetary Outlay |

Rs. 25,938 crore |

|

Target Years |

FY 2022-23 to FY 2026-27 |

|

Domestic Value Addition |

Minimum 50% |

|

Focus |

Advanced Automotive Technology (AAT) products |

|

Targeted Technologies |

Electric Vehicles (EVs) and Hydrogen Fuel-Cell Components |

|

Incentives for EVs and Hydrogen Fuel-Cell Components |

13% – 18% |

|

Incentives for AAT components |

8% – 13% |

|

Investment Attraction |

Global OEMs |

|

Eligibility |

Both domestic and export sales |

- PLI Scheme for Advanced Chemistry Cell (ACC): The Government on 12 May 2021 approved PLI Scheme for manufacturing of ACC in the country with a budgetary outlay of INR 18,100 Crore. The scheme aims to establish a competitive domestic manufacturing ecosystem for 50 GWh of ACC batteries.

- PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) Scheme: This scheme with an outlay of INR 10,900 Crore was notified on 29 September 2024. It is a two-year scheme which aims to support electric vehicles including e-2W, e-3W, e-Trucks, e-buses, e-Ambulances, EV public charging stations and upgradation of vehicle testing agencies.

- PM e-Bus Sewa-Payment Security Mechanism (PSM) Scheme: This Scheme notified on 28 October 2024, has an outlay of INR 3,435.33 Crore and aims to support deployment of more than 38,000 electric buses. The objective of scheme is to provide payment security to e-bus operators in case of default by Public Transport Authorities (PTAs).

- Scheme for Promotion of Manufacturing of Electric Passenger Cars in India (SMEC) was notified on 15 March 2024 to promote the manufacturing of electric cars in India. This requires applicants to invest a minimum of INR 4,150 crore and to achieve a minimum DVA of 25% at the end of the third year and DVA of 50% at the end of the fifth year.

Measures taken by other Ministries include the following initiatives:

- Ministry of Power has issued guidelines and standards for EV Charging Infrastructure titled, “Guidelines for Installation and Operation of Electric Vehicle Charging Infrastructure-2024” on 17 September 2024. These revised guidelines outline standards and protocols to create a connected & interoperable EV charging infrastructure network in the country.

- Ministry of Finance has reduced GST on EVs from 12% to 5%.

- Ministry of Road Transport & Highways (MoRTH) announced that the battery-operated vehicles will be given green plates and be exempted from permit requirements.

- Ministry of Housing and Urban Affairs has amended the Model Building Bye-Laws, mandating the inclusion of charging stations in private and commercial buildings.