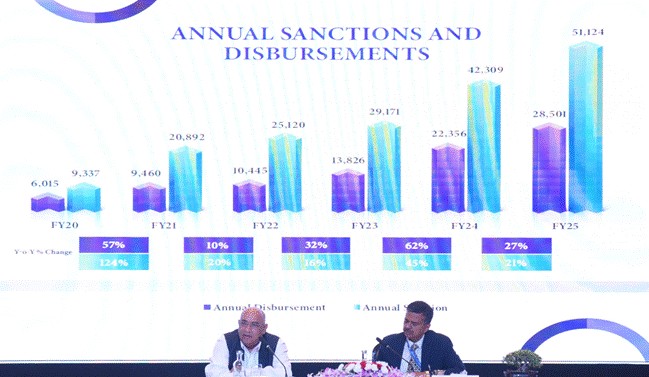

IIFCL recorded highest ever Annual Sanctions and Disbursements of Rs. 51,124 Crore and Rs. 28,501 Crore respectively, during the FY 2024-25, surpassing the previous years’ figures of Rs. 42,309 Crore and Rs. 22,356 Crore respectively, a y-o-y growth of ~21% and ~28% respectively.

The Cumulative Sanctions and Disbursements stood at Rs. 3.06 Lakh Crore and Rs. 1.56 Lakh Crore as of March 31, 2025, of which, ~55% of the Cumulative Sanctions and Disbursements were achieved in the last five years. The Consolidated Cumulative Sanctions and Disbursements of IIFCL stood at ~Rs. 3.53 Lakh Crore and ~Rs. 1.79 Lakh Crore as of March 31, 2025.

Dr. P.R. Jaishankar, Managing Director, India Infrastructure Finance Company Limited (IIFCL) announced all-time high performance of the company yesterday, for the fifth year in a row.

Highest ever Profitability Numbers

IIFCL registered its highest ever Profit before Tax (PBT) of Rs. 2,776 Crore, recording a growth of ~37% over previous year’s PBT of Rs. 2,029 Crore. The Profit after Tax (PAT) grew by ~39% over the previous year to Rs. 2,165 Crore in the FY 2024-25 (up from Rs. 1,552 Crore in FY 2023-24), a ~42x increase over PAT of FY 2019-2020.

Enhanced Net worth

The company’s Net worth grew ~15% to Rs. 16,395 Crore in FY 2024-25 (up from Rs. 14,266 Crore in FY 2023-24 and ~59% over Rs. 10,306 Crore of FY 2019-20), thereby increasing capacity for IIFCL to lend more to infrastructure projects with higher exposure limits.

Growth with Quality

As of March 31, 2025, IIFCL was able to improve its asset quality with a significant decline in Gross NPA ratio to 1.11% (down from 1.61% in the previous year and 19.70% as on 31st March 2020) and Net NPA ratio to 0.35% (down from 0.46% in the previous year, which stood at 9.75% as on March 2020). The proportion of IIFCL’s assets externally rated ‘A’ and above increased to ~93% as of March 31, 2025 (up from ~88% as of March 2024 and ~43% in March 2020), indicating continuous improvement in the quality of company’s assets. IIFCL’s Capital to Risk-weighted Assets (CRAR) comfortably stood at 23.44%, much above the regulatory norms, as on 31st March 2025.

Loan Portfolio Growth

The company recorded y-o-y growth of ~37% in its Standalone Portfolio to Rs. 69,904 Crore in FY 2024-25 from Rs. 51,017 Crore in FY 2023-24.

IIFCL’s Growing Investment in Bonds and InvITs

In order to boost the availability of longer-tenor debt finance for infrastructure projects, IIFCL ventured into investment in Infrastructure Bonds and InvITs in FY 2021-22. Since then, the company has recorded a substantial increase in the investments in Bonds and InvITs with Rs. 29,102 Crore and Rs. 14,220 Crore respectively, till March 31, 2025.

Snapshot of IIFCL’s Performance

Figures in Rs. Crore

|

Particulars |

FY20 |

FY21 |

FY22 |

FY23 |

FY24 |

FY25 |

|

Annual Sanctions |

9,337 |

20,892 |

25,120 |

29,171 |

42,309 |

51,124 |

|

Annual Disbursements |

6,015 |

9,460 |

10,445 |

13,826 |

22,356 |

28,501 |

|

Profit Before Tax (PBT) |

-291 |

315 |

590 |

1,277 |

2,029 |

2,776 |

|

Profit After Tax (PAT) |

51 |

285 |

514 |

1,076 |

1,552 |

2,165 |

|

Gross NPA Ratio |

19.70% |

13.90% |

9.22% |

4.76% |

1.61% |

1.11% |

|

Net NPA Ratio |

9.75% |

5.39% |

3.65% |

1.41% |

0.46% |

0.35% |

|

Total Assets |

52,147 |

55,525 |

56,964 |

59,485 |

65,493 |

81,572 |

|

Net Worth |

10,306 |

10,654 |

11,737 |

12,878 |

14,266 |

16,395 |

|

Asset Quality (A and above) |

43% |

54% |

64% |

72% |

88% |

93% |

|

Provision Coverage Ratio |

50.51% |

61.24% |

62.75% |

70.48% |

71.53% |

68.71% |

|

Outstanding Loans |

33,627 |

36,689 |

39,352 |

42,271 |

51,017 |

69,904 |