It seems that X has had a bit of a turnaround in European usage, with its latest DSA Transparency Report showing that it gained users in the region, adding over 7 million monthly active recipients in the most recent reporting period (April to June 2025).

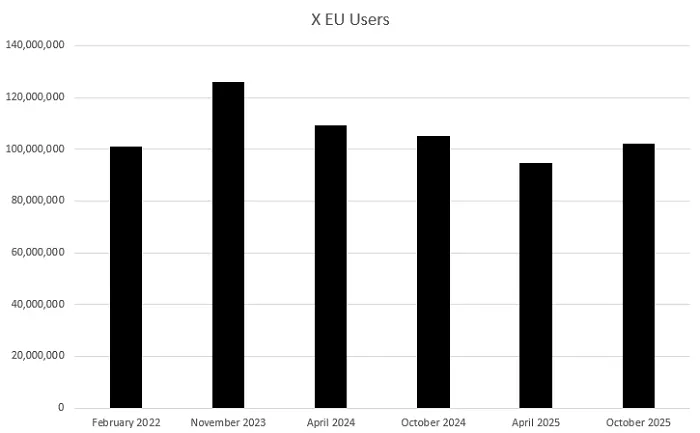

As you can see in this chart, X usage had been on a steady decline since November 2023, when it first began sharing its EU user data, as part of its DSA reporting requirements.

As X is no longer a listed company, it’s not obligated to provide regular active user figures, so we don’t have detailed tracking of X’s total user count over time. The closest we can get is its EU reporting, which, in some ways, could be used as a proxy to indicate the platform’s relative popularity, with EU trends likely reflective of broader usage.

And as noted, these figures had suggested that X was on a steady decline, but maybe, going on this latest update, the platform is gaining at least some traction once again, though it is worth noting that these latest numbers are still down 20% on that November 2023 peak user point.

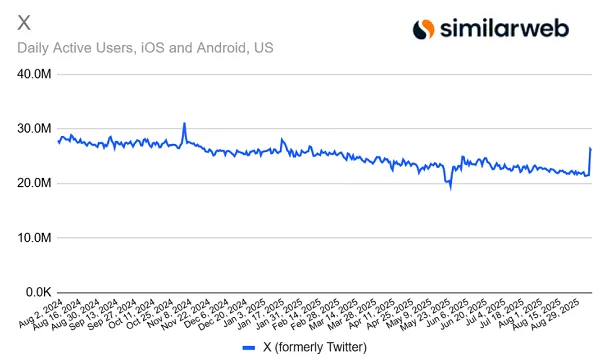

X hired well-known app developer Nikita Bier as its new Head of Product back in June, and Bier has been working to revive the platform’s growth, and improve the product in line with key UI issues. Bier has repeatedly claimed that X is rising in the download charts, even seeing record download levels last month, though app tracking providers have disputed this.

As you can see in this chart, Similarweb data does show that X’s daily active users did spike early in September, though its view was that this was more likely associated with topical issues and trends, as opposed to a broader popularity shift.

But these latest EU figures suggest that X is seeing a rise in broader usage as well, which could mean that, despite the rising challenge from Threads, X remains a relevant and engaging channel for millions of users.

In other words, X is not dead yet, and if you’re looking to maximize your marketing spend, it may still be worth considering the value of X, if that’s where your target users are engaging.

Of course, that’s more difficult to determine than it once was, because since X upped the price of its API access, many apps that used to be able to provide X trend data can no longer do so. Which makes it harder to glean insight into app trends and usage, but in general terms, at least based on EU numbers, we can say that X has seen a rise this year.

Is that because of political content? Sports engagement? Is it because of Grok, and X integrating more AI offerings?

It’s impossible to say without full trend and engagement data, but it’s likely that some of these factors are playing a part.

Though it is also worth noting that the EU region is a minor part of X’s overall audience make-up. North America remains X’s key user market, with Asia (primarily Japan and India) being its next biggest region. EU is a lesser element, but again, given the data access that we have, this is the best indicator we can use at present.

And right now, it shows that X usage has declined in recent years, but it may be coming back. If that trend is sustainable, that is.

In terms of other insights from X’s latest DSA report, it’s further reduced its human moderation team, down from 2,294 people in November 2023, to 1,352 now (-42%).

X is also suspending fewer accounts over time for CSAM content and “Violent and Hateful” activity, though this could also be reflective of previous enforcement having an impact.

You can check out X’s DSA transparency reports here.